Address: Mala Shyianovska (Nemyrovycha-Danchenka) Street, 2, Academic building №4, classroom 4-1105

Phone: +38044-256-21-90

e-mail: [email protected]

![]() https://www.facebook.com/Кафедрацифровізаціїї та бізнес-консалтингу-КНУТД-1604038903185116

https://www.facebook.com/Кафедрацифровізаціїї та бізнес-консалтингу-КНУТД-1604038903185116

Address: Mala Shyianovska (Nemyrovycha-Danchenka) Street, 2, Academic building №4, classroom 4-1105

Phone: +38044-256-21-90

e-mail: [email protected]

![]() https://www.facebook.com/Кафедрацифровізаціїї та бізнес-консалтингу-КНУТД-1604038903185116

https://www.facebook.com/Кафедрацифровізаціїї та бізнес-консалтингу-КНУТД-1604038903185116

Under present economic conditions, it is impossible to imagine an enterprise, institution, or organization in the manufacturing or non-manufacturing field that works efficiently and makes profits in a state of perpetual development, without specialists that organize managerial and financial accounting, internal audit, generate accounting data and perform the functions of control and analysis of business activities. Specialists in the field of accounting and audit generate financial information, important for managers, to take economically substantiated managerial decisions concerning further functioning and optimal dynamic development of an enterprise.

The aim of the Department refers to the improvement of studying process as well as to the provision of professional training of competitive specialists in accountancy and tax management with special competencies, socially-responsible and creative in their profession to satisfy the needs of society and the labour market.

The mission of the Department is to increase and strengthen the educational and professional potential of the state through highly qualified training of competitive specialists in accounting, analysis, audit, and taxation, with deep knowledge of Ukrainian and foreign economy that meet all the requirements of the professional labour market.

Specialist training in the specialty “Accounting and Taxation” at Kyiv National University of Technologies and Design is provided by the Department of Digitization and Business Consulting.

The Department of Audit and Accounting was fundamental at the time of the University’s foundation. The history of its development begins in 1930, when the Faculty of Economics and Engineering included the Department of General Economics and Accounting.

Later, the Department of Economics, Organization and Planning of Leather and Footwear Production was reorganized, and the Department of Economics, Audit and Accounting was established. In 2013, the Department of Economics, Audit and Accounting was reorganized and the Department of Audit and Accounting was created.

To modernize the structure of the University in 2021, the Department of Audit and Accounting was renamed into the Department of Digitization and Business Consulting.

Scientific and applied activities of the Department are focused on training highly qualified specialists in accounting, audit and taxation as well as on disclosure and solution of theoretical and methodological issues of accounting and control, taking into consideration national traditions and trends of historical development of the accountancy profession.

The Department of Digitization and Business Consulting provides specialist training of Bachelor’s, Specialist’s, and Master’s Degrees in the specialty 071 “Accounting and Taxation”.

EDUCATIONAL PROGRAM “ACCOUNTING AND TAXATION”

Degree of higher education - bachelor. Course length - 3 years 10 months.

OUR EDUCATIONAL PROGRAM OFFERS STUDENTS:

After completing the bachelor's program “Accounting and Taxation”, the graduate will be able to demonstrate:

The directions of professional activity of accounting and taxation specialists are:

EDUCATIONAL PROGRAM “INTERNATIONAL ACCOUNTING AND AUDIT CONSULTING”

Degree in Higher Education - Master. Course length - 1 year 4 months

OUR EDUCATIONAL PROGRAM OFFERS:

After completing the program, the graduate will be able to demonstrate:

The directions of specialists’ professional activities are:

- organizations and enterprises of various forms of ownership, engaged in international business activities,

- law firms providing services to Ukrainian and foreign firms in trade policy;

- subdivisions of the state customs;

- institutions; consulates, embassies; diplomatic and trade missions of Ukraine and abroad;

- international media and telecommunication companies;

- international financial institutions and international departments of Ukrainian financial and credit institutions.

- international departments of insurance companies and travel companies.

Student admission is carried out on a competitive basis following the Rules of Admission to the KNUTD, developed in accordance with the conditions of the admission to higher education institutions in Ukraine and approved by the Order of the Ministry of Education and Science of Ukraine. The relevant information can be found at the link: https://en.knutd.edu.ua/learning-opportunities/admissions/

The Department is degree-granting and trains specialists of the following educational levels:

Students study both on a state-commissioned and a contractual basis. After obtaining a bachelor’s degree, students can continue their studies and get a master’s degree.

The course length in full-time and part-time forms for a bachelor’s degree is: for students with complete secondary education – 4 years; for students with the educational degree “Junior Specialist” – 1 year and 10 months full-time and 2 years and 5 months part-time; for the master – 1 year and 4 months.

The scientific activities of the Department of Digitization and Business Consulting are aimed at improving the educational, professional, and personnel work.

The mission of the Department’s scientific activities refers to:

The scientific and research activities are conducted within the theme “The Development of Accounting, Analysis, and Control in Private and State Enterprises Management in terms of European Integration” which includes:

The teaching staff of the Department of Digitization and Business Consulting are engaged in fundamental and applied scientific research.

The Department interacts with leading domestic and foreign centers and educational institutions engaged in scientific activities.

Students, interested in scientific activities, are considered potential scientists. The significant positive experience of the Department’s scientific activities with the students results in their involvement in the research process. In particular, students participate in accounting competitions, Ukrainian and international student conferences, Ukrainian contests of research papers, round-table conferences, and publish the results of their research in professional journals.

Scientific and research aims provide permanent renewal of teaching and methodological provision of the courses, taught at the Department of Digitization and Business Consulting.

The Department administrates term papers, teaching, industrial and scientific practices, rules preparation and defense of papers, and takes a state examination.

The teaching staff of the Department develop scientific programs, publish monographs, study guides, textbooks, papers in domestic and foreign magazines. Great potential for scientific and publishing activities of the Department is provided by scientific cooperation with Ukrainian and foreign educational and scientific institutions.

The research work of the Department of Digitization and Business Consulting is aimed at the improvement of teaching, methodological, professional, and personnel work.

The tasks of the research work of the Department are the following:

The research work is carried out in the direction of “Development of accounting, analytical and control support of the innovative activity of enterprises in the conditions of risk-oriented management” and includes the following:

The Department provides the course planning, educational, industrial, pre-diploma and research practices, preparation and defense of theses taking a complex examination in the specialty.

The research work of the lecturers of the Department is aimed at the development of current accounting and taxation problems and is devoted to the study of conceptual issues of the theory and practice of the Ukrainian tax system formation, an adequate economic policy, focused on solving contemporary social and economic issues, strengthening of territorial cohesion of the country, ensuring the economic growth, and increasing its welfare.

The academic staff of the Department of Digitization and Business Consulting are a team of highly qualified teachers, among them 2 Doctors of Science in Economics, 5 PhDs in Economics, Associate Professors. Educational, scientific, and teaching skills of the academic staff of the Department of Digitization and Business Consulting correspond to the requirements of the higher education standards.

The academic staff provide teaching of all the courses within the “Accounting and Taxation” specialty as well as other economic specialties (Finance and Credit, Personnel Management and Labour Economics, Enterprise Economics, Management, Domestic Services, Tourism Business Management, Merchandising and Enterprise Trading, Economic Cybernetics, Law).

The academic staff of the Department of Digitization and Business Consulting are highly qualified specialists with scientific degrees, academic ranks, experience in teaching, administration, business activities, and work experience in finance.

The Head of the Department is a Doctor of Science in Economics, Professor M. Skrypnyk, a member of the specialized academic council for the defense of dissertations, the author of numerous scientific papers, and is experienced in teaching, methodological and educational work.

SPECIALTIES AND EDUCATIONAL PROGRAMS

|

Specialty: |

071 Accounting and Taxation |

|

FIRST (BACHELOR'S) LEVEL OF HIGHER EDUCATION |

|

|

Educational and professional program |

Digital accounting and tax consulting |

|

SECOND (MASTER’S) LEVEL OF HIGHER EDUCATION |

|

|

Educational and professional program |

International accounting and business consulting |

The academic staff of the Department of Digitization and Business Consulting

|

In 2001, she graduated from Lviv Commercial Academy with a Degree in Audit and Accounting. In 2007, she defended her PhD thesis “Analytical procedures, modelling and decision-making in audit (by the case of the brewery industry in Ukraine). From 2001 to 2007, she worked in the financial structures of the Ukrainian industrial enterprises. At the same time, she combined her research work with business consulting. She is the author of the courses in Management Accounting, Organization and Methods of Audit. Courses taught: “Accounting and reporting in taxation”, “Reporting of enterprise”, “Account and financial reporting on international standards”, “Enterprise Accounting Policy”, “International Standards (ISFR, ISA)”, “Accounting and Taxation”. Research interests: modeling of accounting, analytical and audit procedures, research of the contractual process in the context of modern Ukraine, development of analytical tools while forming a business model, international accounting and audit standards. The author of over 75 research papers and methodological study aids, a co-author of 8 monographs. |

|

In 1993, he graduated from Zhytomyr Agricultural Institute with a Degree in Economics and Management in the Agroindustrial Sector. In 1999, he defended his PhD thesis “Employment of rural population”. In 2003, he became an Associate Professor of the Department. Courses taught: “Accounting”, “Financial Accounting”, “Accounting and reporting at enterprises of small business”, “Accounting of international agreements”, “Accounting and taxation of currency and credit operations”, “Accounting of Transnational Corporations”. Research interests: the concept of management accounting organization in the presence of information technologies. The author of over 120 research papers and methodological study aids, a co-author of 5 monographs, 2 textbooks approved by the Ministry of Education and Science of Ukraine (“Accounting in Manufacturing Sector”, “Accounting in Foreign Countries”). |

|

In 1995, she graduated from Eastern Ukrainian State University with a degree in Accounting, Control, and Inspection of Economic Activity. In 2007, she graduated from Volodymyr Dahl Eastern Ukrainian National University with a Degree in Marketing. In 2010, she defended her PhD thesis “Organizational and economic support of innovative development management of machine builders”. In 2013, she became an Associate Professor of the Department of Economics, Audit and Accounting. In 2020, she defended her doctoral dissertation “Methodological foundations of enterprise cost management in the market conditions”. In 2021, she became a Professor of the Department of Audit and Accounting. Courses taught: “Audit”, “Accounting and information systems and technologies in audit and accounting”, “Audit of transnational corporations”, “Audit-consulting of international contractual relations:, “Methodology of modern scientific research on the basics of intellectual property”, “Accounting and analytical support of transfer pricing”. English – fluent (Certificate B2). Research interests: the concept of control development in the presence of modern information technologies, cost management of the enterprise in modern conditions. She has experience of working in the specialty for more than 10 years as a senior tax auditor and accountant. The author of over 150 research papers and methodological study aids, two single monographs, co-author of 7 monographs, 1 textbook (“Accounting in diagrams and tables”), 5 copyright certificates. |

|

In 2008, she graduated from Zhytomyr State Technological University with a degree in Finances. In 2012, she defended her PhD thesis “Accounting and analysis of borrowed capital accumulation and disposal”. In 2015, she was honored with a diploma from Bohunska district Administration in Zhytomyr for professional scientific, teaching, and public activities. Courses taught: Accounting and taxation. Research interests: issues of accounting and control of borrowed capital activities. She is the author of more than 100 scientific and methodological papers, co-author of 3 textbooks. |

|

In 1998, she graduated from Kirovohrad Institute of Agriculture Machine Building with a degree in “Audit and Accounting. In 2004, she defended her PhD thesis “Accounting and control of inventories (by the enterprise of milk processing industry of Ukraine)” In 2008, she obtained the academic status of Associate Professor of the Department of Audit and Accounting. In 2009, she was honored with a diploma from Kyiv City Mayor for significant personal contribution to the development of national science and strengthening the scientific and technical potential of the capital. Courses taught: Enterprise accounting policy. Research interests: conception of accounting system transformation of public sector institutions. The author of more than 150 research and 275 methodological papers and co-author of 1 textbook and 4 monographs. |

|

In 2005, he graduated from Kyiv National University of Technologies and Design, specializing in “Light industry equipment and consumer services” and in the same year graduated from the Institute of Postgraduate Education of Kyiv National University of Technologies and Design, specializing in “Audit and Accounting”. In 2017, he defended his PhD thesis “Organizational and economic mechanism of investment potential management of higher educational institutions”. Courses taught: Accounting in state-financed institutions. Research interests: development of organization regulations and managerial accounting methods as an enterprise information management system. The author of more than 20 scientific and methodological works, and co-author of 2 monographs. |

In recent years, the Department provides training for more than 200 students.

Students’ Scientific Achievements:

Students of the Department of Digitization and Business Consulting show high activity in scientific competitions in the specialized fields, and the most active of them prepare the completed scientific works and present them in the II Round of the All-Ukrainian Competition of Student Research Papers, held annually in different branches of knowledge in various institutions of higher education, the purpose of which is the formation of students of research competence.

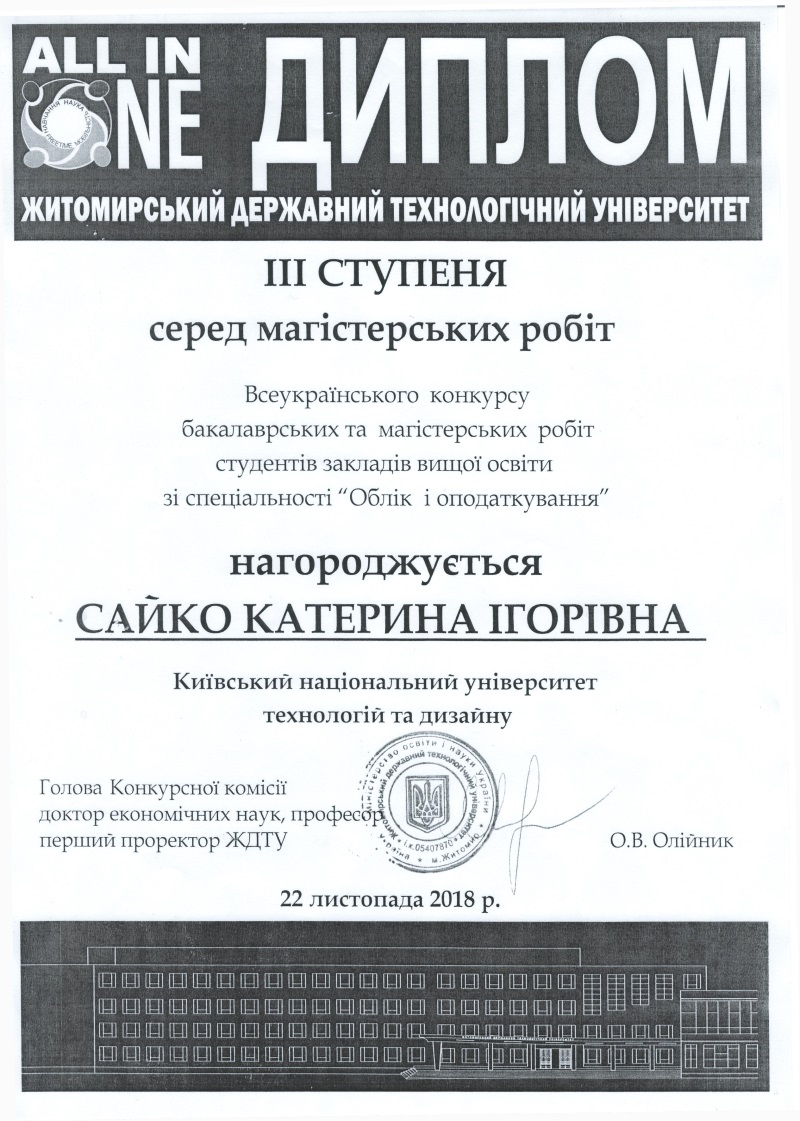

The winner of the II Round of the All-Ukrainian Competition of Student Research Papers in the specialty “Accounting and Taxation”, which took place at the National Academy of Statistics, Accounting and Audit, became a Master’s degree student Kateryna Saiko, who won the 3rd-degree Diploma (2018).

The prize and 3rd-degree diploma among the master’s works at the All-Ukrainian Competition of Undergraduate and Master's Works of Students of Higher Education Institutions in the specialty “Accounting and Taxation”, held at Zhytomyr State Technological University in November 2018, was awarded a Master’s degree student Kateryna Saiko.

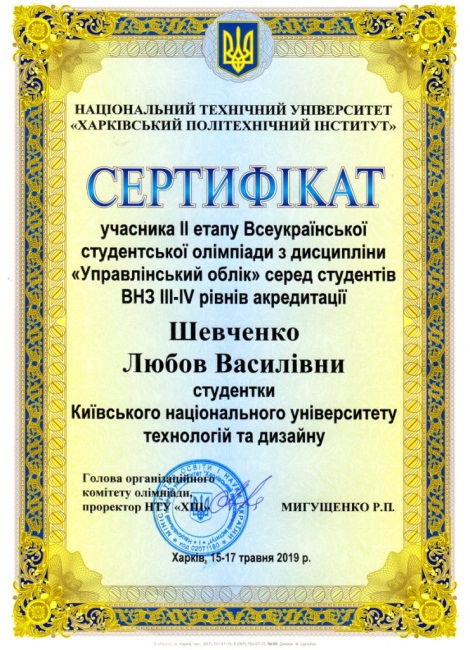

In 2019, students of the specialty “Accounting and Taxation” became the winners of many All-Ukrainian Olympiads, namely:

The winners of the All-Ukrainian Student Olympiad in Accounting and Taxation organized by the Department of Digitization and Business Consulting of Kyiv National University of Technologies and Design:

Tatyana Vityuk (1st place), Lyubov Shevchenko (2nd place), Karina Shchur (3rd place).

The winners of the All-Ukrainian Student Olympiad in the courses were:

Management Accounting – Tetyana Vitiuk (1st place), Lyubov Shevchenko (2nd place), Yana Didyk (3rd place);

Audit – Tetyana Vitiuk (1st place), Iryna Haydey (2nd place), Karina Shchur (3rd place);

Accounting and Reporting at Small Business Enterprises - Olena Parkhomenko (1st place), Iryna Haydey (2nd place), Lyubov Shevchenko (3rd place);

Accounting in Banks – Lyubov Shevchenko (1st place), Tetyana Vitiuk (2nd place), Karina Shchur (3rd place);

Analysis of economic activity – Tetyana Vitiuk (1st place), Yana Didyk (2nd place), Lyubov Shevchenko (3rd place);

Accounting Information Systems and Technologies in Analysis and Audit – Tetyana Vitiuk (1st place), Lyubov Shevchenko (2nd place), Karina Shchur (3rd place);

Financial Accounting – Yana Didyk (1st place), Kateryna Bilous (2nd place), Olena Krutous (3rd place).

The winners of the subsection “Organizational and methodological aspects of audit and accounting of innovative activities of Ukrainian enterprises” of the XVII All-Ukrainian Scientific Conference of Young Scientists and Students “SCIENTIFIC DEVELOPMENT OF YOUTH AT THE MODERN STAGE” were Yana Didyk, Marco Lebedev (3rd place).

For successful execution and practical realization of the youth education concept of the Department of Digitization and Business Consulting develops an annual plan of students’ education, including activities, directed to the personal development of each student.

A complex approach to education includes different fields: public and patriotic, moral and esthetic, legislative, professional and labour, preventive health, art and esthetic.

There is the student community Professional Studio of Accounting and Taxation at the Department Digitization and Business Consulting.

The objective of the community is to deepen students’ theoretical and practical knowledge concerning analytical estimation in scientific and research problems of audit and digital accounting in the context of the postindustrial economy, to form a role of an accounting expert at the present stage of enterprise management.

The chief instructor of the community is Associate Professor Olha Bunda.

The student scientific community is a voluntary non-profit association of students engaged in the extra-curriculum scientific and research work.

The work of the community involves:

The following topics at the sessions of the community are discussed:

The work of the seminar is based on academic interests relating to the investigation of theory and practice problems of audit and accounting, namely, accounting procedures in corporations, socially-oriented accounting, ecological activity accounting, internal accounting procedures, management accounting, and budgeting, accounting in the presence of inflation processes, taxation, organization, and techniques of economic analysis.

The results are the accomplishment of competitive students’ scientific works, scientific articles, and abstracts written in a foreign language.

The work of the seminar is based on the academic courses taught by the Department of Digitization and Business Consulting, discussion sessions are held in a scientific discussion format which allows for building and the development of the outlook of the students who are doing Bachelor’s and Master’s degrees.

The sessions of the seminar are organized in such a way that students have an opportunity to gain deep knowledge of an accountant job, understand the current state of audit and accounting, identify the directions of their development, learn to form suggestions concerning accounting improvement, understand its international significance, compare audit and accounting in Ukraine and other countries, identify advantages and disadvantages of the national audit and accounting systems.

To get closer to the conditions of practical work, the students consider non-standard and problematic situations in the tax legislation, the peculiarities of accounting at the enterprises of different forms of economic activity that ensures the formation of necessary skills and abilities to disclose in accounting reports the operation from its beginning to the final financial result calculation, and the forecasting of its economic effects as well.

Within the years of its existence, the Department has trained many qualified specialists in accounting, audit, and management, who found their workplaces in higher educational institutions, at enterprises, in organizations of different types of ownership, in research, administrative, and public institutions.

Graduates are entitled to professional knowledge and skills, the state problems orientation, responsibility, patriotism, and a high level of national identity.

The graduates of the Department of Digitization and Business Consulting work in financial institutions, insurance companies, financial and tax offices, audit and consulting companies, companies with foreign capital, at the enterprises of light industry, public catering, utility services, in commercial companies, construction companies, at motor transport enterprises, agricultural enterprises, enterprises of food and pharmaceutical industries.

The most well-known are:

M. Verhun – a chief accountant of KNUTD;

V. Kuzenny – a 1-st category accountant of KNUTD;

L. Chuprina – a tax inspector of the State Tax Inspectorate in Pechersk district of the Main Directorate of the Ministry of Revenue in Kyiv;

L. Butrymas – an accountant at Feofania Central Military Hospital;

O. Kostyushko – an accountant of Bosch-Siemens Company;

K. Bezverhy – a chief accountant of LLC “TIS-TRANS”and LLC “New Paris”;

K. Saiko – a chief specialist of the department of personalized accounting of privileges of the Department of Labor and Social Protection of the Population of the Pechersk District State Administration in Kyiv;

O. Yosypenko – a chief specialist of the Department of Appointment and Calculation of Subsidies of the Labor and Social Protection Department of the Pechersk District State Administration in Kyiv;

L. Locksmith – a chief auditor of Oschadbank JSC;

I. Rudobaba – Chief Accountant of the Planning and Finance Department of the National Center "Small Academy of Sciences of Ukraine";

V. Antonets – MD Fashion payroll specialist;

M. Lipovenko – a chief specialist of the Department of Damage Management, Medical Examination, TD “Naftogazstrakh” Insurance Company;

O. Shovtenko – an audit specialist at “Ernst & Young Audit Services (E&Y)”;

A. Kiselev – an accountant “Door Olympus Company”;

V. Kalyanovskaya – Deputy Head of the Financial Affairs Department of TD “Naftogazstrakh” Insurance Company;

M. Plakhotniuk – an accountant of “Accounting Express” LLC;

N. Lukyanova – an accountant of “GTP” LLC.

The Department has been working with students who are citizens of other countries.

Cooperating with foreign partners, the Department trains specialists for Azerbaijan, Bulgaria, Hungary, Georgia, Germany, Mongolia, Cuba, Vietnam, Nicaragua, Costa Rica, Ethiopia, China, Russia, Moldova, Turkmenistan, and other countries.

The work with international students is based on familiarization with our country, Ukrainian people’s traditions, history, and culture. While they are staying in Ukraine, the Department of Digitization and Business Consulting organizes sightseeing tours across Kyiv, the Kyiv region, and Ukraine.

International students are engaged in the scientific and research work of the Department, in social events and actions of Kyiv National University of Technologies and Design.

Students of the specialty “Accounting and Taxation” have the opportunity to obtain a double-degree diploma and simultaneously receive a Master’s degree in the specialties of the School of Management in Warsaw: “Banking and Finance Management? (WSM), “Enterprise Management in a United Europe” (WSM).