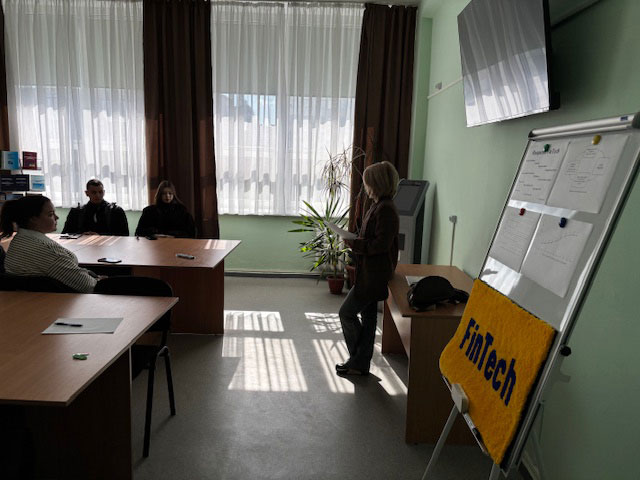

On April 3 and 11, 2025, the Department of Finance and Business Consulting organized open practical classes aimed at integrating practice-oriented training with theoretical studies. These sessions were part of the educational components “Banking System” and “Introduction to Finance and Financial Business” for first- and third-year students majoring in 072 “Finance, Banking, Insurance and Stock Market” and 071 “Accounting and Taxation”.

The classes were conducted with the participation of FUIB experts: Volodymyr Kostin, Head of the Group of Branches of the Kyiv Regional Center at JSC FUIB, and Kateryna Mohyla, Manager of Pechersk Branch No. 24 of FUIB in Kyiv.

On April 3, a practical session with Volodymyr Kostin focused on issues of fraud in the banking sector and the methods used to combat it. The discussion also covered the specifics of Interchange rate formation and the history of the Interchange Fee. In addition, part of the session was dedicated to financial monitoring in banks during wartime, highlighting key nuances, risks, and consequences.

On April 11, Kateryna Mohyla, Branch Manager at FUIB, began the practical training with an overview of the bank's operations, placing special emphasis on customer service and financial products. A significant portion of the session focused on loan-related cases — one of the most in-demand banking services.Katery na explained the full loan approval process, detailing how the bank evaluates risk, assesses client solvency, and selects optimal loan terms tailored to each application. This provided students with valuable insight into how complex financial models and theoretical risk management principles are applied in real-world banking scenarios.

Additionally, the speaker addressed the topic of managing overdue loans, with a particular focus on the “loan forgiveness” procedure for citizens residing in temporarily occupied territories.

During the meeting with the speakers, the students were familiarized with the main regulatory documents that guide banking institutions in the implementation of financial monitoring. For example, with the Law of Ukraine “On Prevention and Counteraction to Legalization (Laundering) of Proceeds of Crime, Terrorist Financing and Financing of Proliferation of Weapons of Mass Destruction”, the NBU Resolution “On Approval of the Regulation on Financial Monitoring by Banks”. Attention was also paid to the main requirements of this Regulation.

Volodymyr Kostin and Kateryna Mohyla shared their professional experience in working with clients, emphasizing that a bank employee’s expertise extends beyond financial knowledge to include strong communication and psychological skills.

During the practical sessions, students asked numerous questions about the specifics of banking operations, particularly in the context of martial law. The speakers provided detailed professional responses and practical advice.

Such hands-on events offer students invaluable experience, helping them to better understand the career opportunities that await them in the banking sector and beyond.

17.04.2025